All Categories

Featured

Table of Contents

Of training course, there are other benefits to any whole life insurance policy. While you are trying to decrease the proportion of costs to fatality benefit, you can not have a plan with zero fatality advantage.

Some individuals offering these policies say that you are not interrupting compound passion if you obtain from your plan instead than take out from your bank account. The cash you borrow out earns absolutely nothing (at bestif you do not have a wash financing, it might also be costing you).

That's it. Not so attractive now is it? A lot of individuals that buy into this principle likewise acquire right into conspiracy theories about the globe, its governments, and its banking system. IB/BOY/LEAP is positioned as a means to somehow stay clear of the world's financial system as if the world's largest insurance coverage companies were not part of its economic system.

It is spent in the general fund of the insurance company, which primarily buys bonds such as United States treasury bonds. No magic. No change. You obtain a bit greater rate of interest on your cash (after the first couple of years) and perhaps some property protection. That's it. Like your financial investments, your life insurance policy need to be dull.

Infinite Banking Policy

It feels like the name of this concept adjustments as soon as a month. You may have heard it described as a perpetual riches strategy, family financial, or circle of riches. No matter what name it's called, limitless financial is pitched as a secret way to build riches that just abundant people learn about.

You, the insurance policy holder, put money right into a whole life insurance policy via paying premiums and getting paid-up additions. This raises the cash money worth of the plan, which implies there is even more cash money for the reward rate to be used to, which normally indicates a higher rate of return overall. Dividend prices at major service providers are currently around 5% to 6%.

What Is Infinite Banking Life Insurance

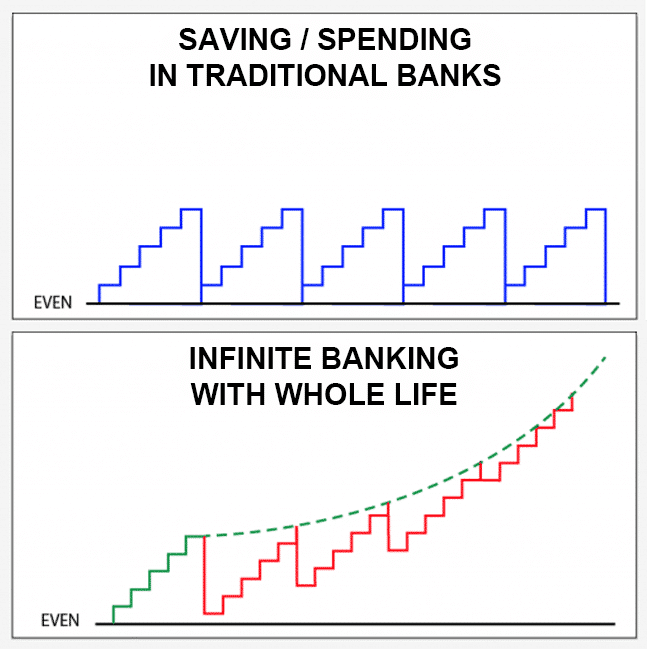

The entire concept of "banking on yourself" just functions since you can "bank" on yourself by taking loans from the plan (the arrow in the chart over going from whole life insurance back to the insurance holder). There are 2 different kinds of car loans the insurance provider may supply, either direct recognition or non-direct recognition.

One function called "wash loans" sets the interest price on fundings to the exact same price as the reward rate. This implies you can borrow from the policy without paying passion or obtaining interest on the amount you borrow. The draw of infinite financial is a reward rates of interest and assured minimum rate of return.

The downsides of boundless banking are often overlooked or not stated at all (much of the details readily available regarding this idea is from insurance policy agents, which may be a little biased). Only the cash money worth is expanding at the dividend price. You additionally have to spend for the cost of insurance coverage, fees, and expenditures.

Every irreversible life insurance plan is different, but it's clear somebody's overall return on every dollar invested on an insurance coverage product can not be anywhere close to the dividend price for the plan.

Visa Infinite Alliance Bank

To offer a very fundamental and theoretical example, allow's assume a person is able to gain 3%, usually, for every dollar they invest in an "unlimited financial" insurance coverage item (besides expenses and costs). This is double the estimated return of whole life insurance policy from Consumer News of 1.5%. If we presume those bucks would certainly undergo 50% in taxes complete if not in the insurance coverage item, the tax-adjusted price of return could be 4.5%.

We assume greater than ordinary returns overall life item and a really high tax price on bucks not place right into the plan (that makes the insurance policy item look much better). The reality for several individuals may be even worse. This pales in comparison to the long-term return of the S&P 500 of over 10%.

Royal Bank Infinite Visa Rewards

At the end of the day you are acquiring an insurance item. We love the defense that insurance coverage offers, which can be obtained a lot less expensively from a low-cost term life insurance coverage plan. Unpaid finances from the plan may likewise minimize your survivor benefit, diminishing another level of security in the plan.

The concept just works when you not only pay the significant costs, yet utilize extra money to acquire paid-up additions. The chance expense of all of those bucks is incredible exceptionally so when you might rather be buying a Roth IRA, HSA, or 401(k). Also when contrasted to a taxed financial investment account and even an interest-bearing account, boundless financial might not supply comparable returns (contrasted to spending) and similar liquidity, accessibility, and low/no cost structure (contrasted to a high-yield interest-bearing accounts).

When it pertains to financial planning, whole life insurance often stands out as a popular alternative. There's been an expanding pattern of advertising and marketing it as a device for "limitless banking." If you've been discovering entire life insurance policy or have found this idea, you may have been told that it can be a method to "become your very own financial institution." While the idea could seem attractive, it's essential to dig deeper to comprehend what this really suggests and why watching entire life insurance this way can be misleading.

The idea of "being your own bank" is appealing because it recommends a high degree of control over your financial resources. This control can be illusory. Insurance provider have the best say in exactly how your policy is taken care of, including the regards to the financings and the rates of return on your cash money worth.

If you're considering whole life insurance policy, it's vital to watch it in a wider context. Whole life insurance can be a useful device for estate planning, offering an assured death benefit to your beneficiaries and potentially supplying tax benefits. It can also be a forced savings car for those that battle to conserve cash constantly.

How To Be Your Own Bank

It's a type of insurance coverage with a cost savings element. While it can offer constant, low-risk growth of cash worth, the returns are generally lower than what you could attain via other investment vehicles. Prior to jumping into whole life insurance policy with the concept of boundless financial in mind, put in the time to consider your monetary goals, danger resistance, and the full series of financial products offered to you.

Infinite banking is not an economic remedy. While it can operate in particular scenarios, it's not without dangers, and it needs a significant dedication and comprehending to handle efficiently. By acknowledging the prospective mistakes and recognizing real nature of entire life insurance policy, you'll be better equipped to make an informed decision that sustains your economic wellness.

This book will show you how to set up a financial plan and exactly how to make use of the financial policy to buy property.

Limitless banking is not a services or product provided by a certain organization. Infinite financial is an approach in which you acquire a life insurance policy policy that gathers interest-earning money worth and get car loans against it, "borrowing from yourself" as a source of resources. At some point pay back the finance and start the cycle all over again.

Pay policy premiums, a section of which constructs money worth. Cash worth makes worsening interest. Take a financing out against the policy's cash money value, tax-free. Pay off lendings with interest. Money value accumulates once again, and the cycle repeats. If you use this principle as intended, you're taking money out of your life insurance policy policy to acquire whatever you would certainly require for the remainder of your life.

Latest Posts

Become Your Own Bank. Infinite Banking

How To Become Your Own Bank Explained‼️ - How To ...

Whole Life Infinite Banking