All Categories

Featured

Table of Contents

For the majority of individuals, the largest issue with the unlimited banking concept is that initial hit to early liquidity triggered by the expenses. Although this disadvantage of infinite banking can be minimized considerably with appropriate plan design, the very first years will always be the worst years with any type of Whole Life policy.

That stated, there are specific boundless banking life insurance policy plans developed mainly for high very early cash worth (HECV) of over 90% in the first year. The lasting efficiency will certainly commonly significantly lag the best-performing Infinite Financial life insurance policies. Having accessibility to that extra four numbers in the first couple of years may come with the cost of 6-figures later on.

You in fact obtain some considerable long-term benefits that assist you recover these very early prices and after that some. We find that this prevented early liquidity trouble with limitless financial is a lot more mental than anything else as soon as completely explored. If they absolutely required every cent of the cash missing from their limitless financial life insurance coverage plan in the first few years.

Tag: boundless banking concept In this episode, I discuss financial resources with Mary Jo Irmen that educates the Infinite Banking Idea. This topic may be controversial, however I intend to get varied views on the show and find out about different methods for farm financial management. Several of you may concur and others will not, yet Mary Jo brings an actually... With the increase of TikTok as an information-sharing platform, monetary recommendations and approaches have actually located an unique method of dispersing. One such strategy that has actually been making the rounds is the boundless banking idea, or IBC for short, amassing recommendations from celebs like rap artist Waka Flocka Flame. However, while the method is presently prominent, its origins trace back to the 1980s when financial expert Nelson Nash introduced it to the world.

Within these policies, the cash money worth expands based on a rate established by the insurer. Once a considerable cash money worth accumulates, insurance holders can acquire a money value loan. These fundings vary from standard ones, with life insurance coverage acting as collateral, suggesting one can lose their coverage if borrowing excessively without adequate cash worth to sustain the insurance expenses.

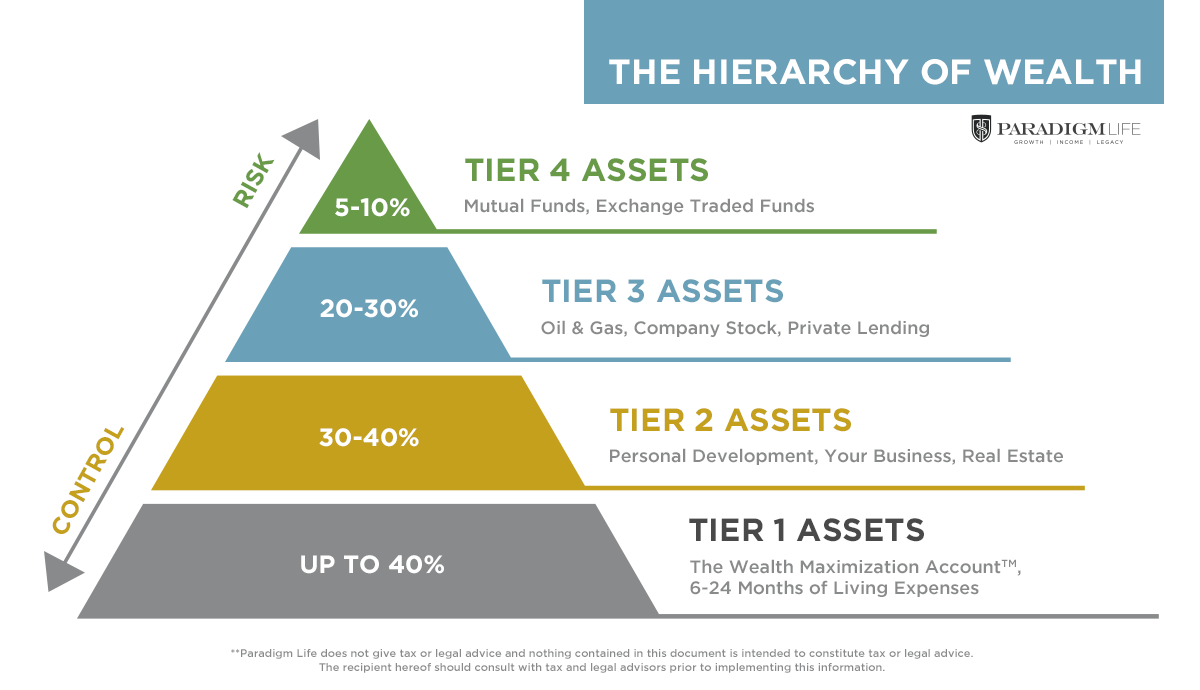

And while the appeal of these plans appears, there are innate constraints and dangers, necessitating persistent cash value tracking. The method's legitimacy isn't black and white. For high-net-worth individuals or organization owners, especially those making use of approaches like company-owned life insurance (COLI), the advantages of tax obligation breaks and compound development might be appealing.

Rbc Private Banking Visa Infinite

The appeal of limitless banking does not negate its obstacles: Price: The foundational need, a long-term life insurance policy policy, is costlier than its term equivalents. Qualification: Not everybody certifies for entire life insurance policy as a result of strenuous underwriting procedures that can omit those with specific health or lifestyle problems. Intricacy and risk: The intricate nature of IBC, combined with its risks, may prevent several, specifically when less complex and less high-risk options are readily available.

Allocating around 10% of your regular monthly revenue to the policy is simply not feasible for the majority of people. Utilizing life insurance policy as an investment and liquidity source requires technique and monitoring of plan cash money value. Seek advice from an economic advisor to identify if limitless financial lines up with your top priorities. Component of what you read below is simply a reiteration of what has currently been stated over.

Prior to you obtain on your own into a situation you're not prepared for, know the complying with initially: Although the concept is generally marketed as such, you're not really taking a lending from on your own. If that were the instance, you wouldn't need to settle it. Rather, you're borrowing from the insurance policy company and need to repay it with interest.

Some social media blog posts recommend making use of money worth from entire life insurance coverage to pay down bank card financial obligation. The concept is that when you pay back the finance with interest, the quantity will be returned to your financial investments. That's not just how it functions. When you pay back the car loan, a portion of that rate of interest goes to the insurer.

For the first numerous years, you'll be paying off the payment. This makes it incredibly challenging for your plan to gather worth during this time. Unless you can afford to pay a couple of to numerous hundred dollars for the following years or even more, IBC will not function for you.

Unlimited Banking Solutions

Not every person should count solely on themselves for economic security. If you need life insurance policy, below are some useful ideas to think about: Think about term life insurance. These policies offer coverage throughout years with substantial economic obligations, like home mortgages, trainee fundings, or when looking after little ones. See to it to look around for the finest rate.

Copyright (c) 2023, Intercom, Inc. () with Reserved Typeface Call "Montserrat". This Font Software application is accredited under the SIL Open Font Certificate, Variation 1.1. Copyright (c) 2023, Intercom, Inc. (legal@intercom.io) with Scheduled Font Call "Montserrat". This Typeface Software program is accredited under the SIL Open Up Typeface Permit, Version 1.1.Avoid to primary content

Royal Bank Infinite Avion Points

As a certified public accountant concentrating on actual estate investing, I have actually combed shoulders with the "Infinite Financial Principle" (IBC) much more times than I can count. I have actually also spoken with experts on the topic. The primary draw, other than the obvious life insurance policy advantages, was always the idea of accumulating money worth within a permanent life insurance policy and loaning against it.

Sure, that makes good sense. Honestly, I always thought that money would be much better spent directly on investments instead than funneling it via a life insurance coverage plan Up until I uncovered just how IBC might be integrated with an Irrevocable Life Insurance Depend On (ILIT) to create generational riches. Allow's begin with the essentials.

Td Bank Visa Infinite Card

When you borrow against your plan's cash worth, there's no collection payment routine, offering you the freedom to manage the car loan on your terms. The money value continues to grow based on the policy's warranties and rewards. This setup permits you to access liquidity without interrupting the long-lasting growth of your plan, offered that the financing and rate of interest are handled sensibly.

The process continues with future generations. As grandchildren are birthed and grow up, the ILIT can buy life insurance coverage policies on their lives. The trust fund then builds up multiple plans, each with growing money values and fatality benefits. With these plans in position, the ILIT effectively ends up being a "Family Bank." Household participants can take lendings from the ILIT, making use of the cash money worth of the policies to money investments, start organizations, or cover major costs.

A critical aspect of handling this Family members Financial institution is making use of the HEMS criterion, which stands for "Health, Education And Learning, Upkeep, or Assistance." This guideline is often included in depend on agreements to direct the trustee on just how they can disperse funds to beneficiaries. By adhering to the HEMS standard, the depend on ensures that distributions are created vital requirements and long-lasting assistance, safeguarding the count on's properties while still providing for relative.

Enhanced Adaptability: Unlike stiff small business loan, you regulate the repayment terms when borrowing from your very own plan. This allows you to structure payments in a manner that aligns with your business money circulation. public bank infinite. Enhanced Money Flow: By funding company expenditures through policy loans, you can potentially free up cash money that would certainly otherwise be locked up in standard finance payments or equipment leases

He has the very same equipment, yet has actually also developed added cash value in his policy and obtained tax benefits. And also, he now has $50,000 offered in his policy to utilize for future possibilities or costs. In spite of its prospective benefits, some individuals continue to be doubtful of the Infinite Financial Principle. Allow's attend to a couple of usual problems: "Isn't this just costly life insurance policy?" While it's true that the costs for an effectively structured entire life policy may be greater than term insurance, it is necessary to watch it as greater than simply life insurance policy.

Nelson Nash Net Worth

It's about creating a versatile funding system that gives you control and gives numerous advantages. When used strategically, it can enhance other investments and company methods. If you're captivated by the potential of the Infinite Financial Idea for your organization, below are some actions to take into consideration: Educate Yourself: Dive much deeper into the concept through trusted publications, seminars, or consultations with well-informed professionals.

Latest Posts

Become Your Own Bank. Infinite Banking

How To Become Your Own Bank Explained‼️ - How To ...

Whole Life Infinite Banking